As we approach the end of 2023, Yole Group’s analysts contemplate the factors influencing ADAS and AD and go deeper into the implementation of electrification. What are the innovations that stood out this year? Who is leading in automotive semiconductors? What is the impact of the trade war between China and the United States and the conflict between Russia and Ukraine?

Stepping back, analysts Yu Yang and Pierrick Boulay from Yole Intelligence, part of Yole Group, shift their focus to the semiconductor technologies, analyze how the market evolved in 2023, and explain their expectations for the new year. Combining their expertise, both experts delve into market trends, recent innovations, ecosystem evolution, and, notably, the supply chain within each sector.

This review is based on Yole Group’s automotive collection. Yole Intelligence and Yole SystemPlus are Yole Group companies.

Electrification: Is It Happening Now? Not Really...

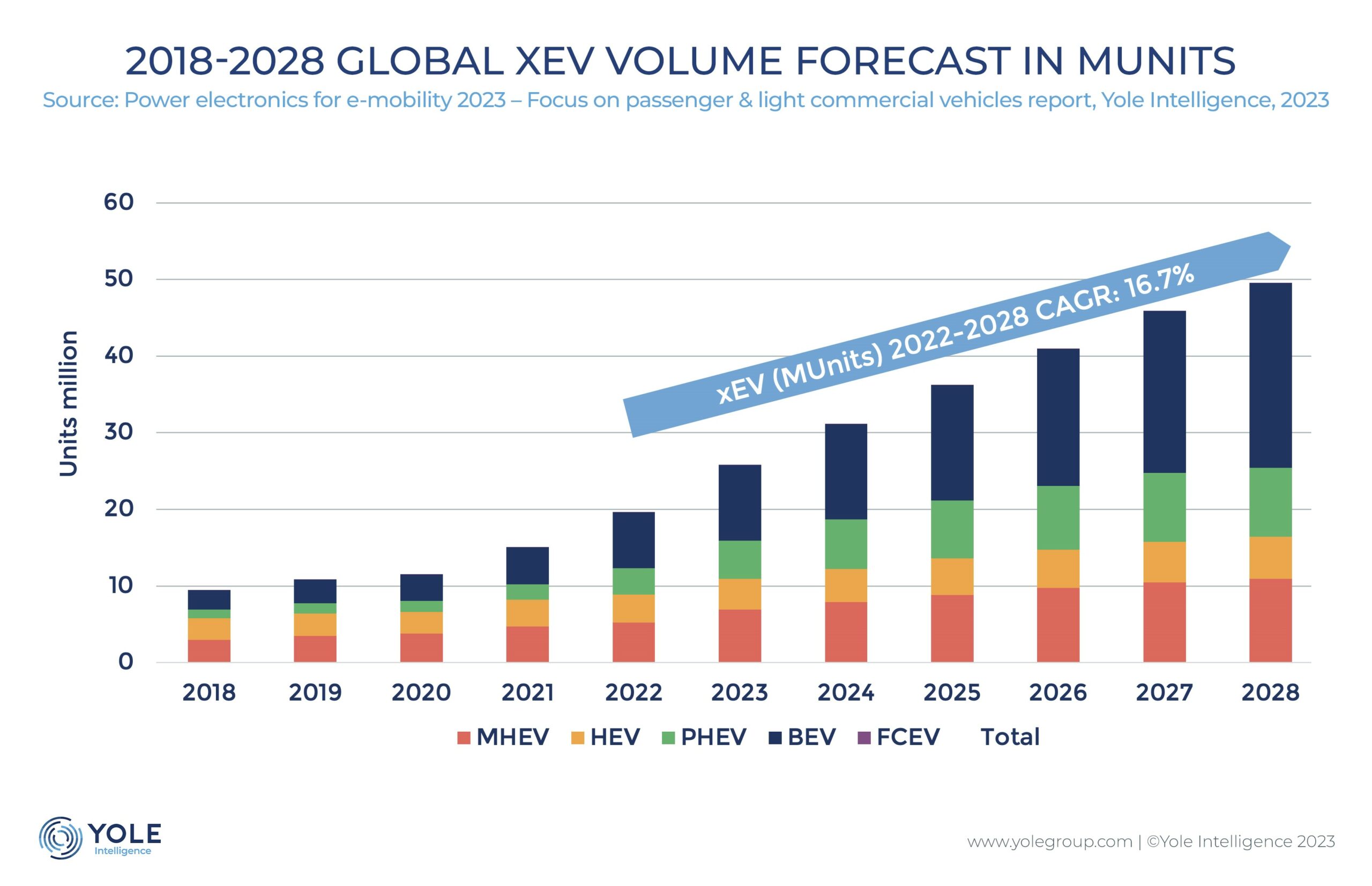

According to the report "Power Electronics for e-Mobility 2023" from Yole Group, vehicle electrification is speeding up globally within the major markets. The global LD vehicle market will reach 93 million units in 2028, with a 53.5% market share for xEV. Among various electrification technologies, BEV leads the market with a 22.1% CAGR between 2022 and 2028, while xEV ‘s annual growth is 16.7% over the same period.

In the second half of 2023, there are signs that the rate of electrification in the global automotive market is slowing.

This is no surprise for Yole Group’s long-term customers, as the actual BEV adoption speed is rather in line with Yole Group forecasts, which have been more moderate and had a stronger focus on PHEV for the next years. There is no doubt electrification is an established trend, but it will not happen overnight. However, we see several positive factors, spanning from SiC substrate supply, to launching plans of models working at 800 V, to fast implementation of high-power charging infrastructure, signal a quick adoption of SiC, in combination with 800 V platforms.

Yu Yang, principal technology and market analyst, power electronics at Yole Intelligence, part of Yole Group, within the power & wireless division, said “It will take decades for full electrification and forecasts include the various hybrid technologies which will fill the gap during the transition period.”

What—or Who—is a Safe Bet in ADAS in 2024?

As 2023 draws to a close, Yole Group’s analysts reflect on developments driving ADAS and AD. Legacy sensors will share the market with new sensor technologies. 5.4 billion sensors, including imaging sensors, magnetic sensors, and MEMS pressure sensors among many others for the automotive market, were shipped in 2022 globally. And with a strong 7% growth between 2022 and 2028, the market research and strategy consulting company expects it will grow to 8.3 billion sensors shipped worldwide ("Semiconductor Sensors for Automotive" report, 2023):

- For standard or legacy image sensors, little has changed regarding the main players, which remain onsemi, Omnivision, and Sony. What has changed, as safety features evolve, has been the resolution, which has increased from 1-2 Mpixel to today’s design wins relating to 8 Mpixel cameras. Automotive thermal camera adoption could change in the future depending on future AEB regulation in the U.S.

- Automotive computing demand is growing, creating business opportunities.

The increasing number of sensors with improved range and resolution are directly impacting the need for computing power in passenger cars. Computing revenue for ADAS and cockpit processors is increasing quickly, with a 13% CAGR between 2022 and 2028 to $12.7 billion. Among these two categories, ADAS is the largest segment, representing more than 60% of the revenue in 2028 (according to the "Computing & AI for Automotive" report).

There are also interesting changes in the computing market. Mobileye has dominated the automotive vision processor market for a long time, accounting for a 52% market share in 2022, followed by players like AMD, Nvidia, and Tesla.

Qualcomm, a new player compared to competitors Renesas and NXP, dominates the cockpit processor market. Qualcomm entered the automotive market through the cockpit, leveraging its knowledge of user experience acquired in the smartphone market. But the ultimate goal of Qualcomm is not the cockpit market; it is the much more lucrative ADAS market…

Pierrick Boulay, senior technology & market analyst in the photonics and sensing division at Yole Intelligence, part of Yole Group, said “Already some players such as BMW and Volkswagen are moving away from Mobileye to Qualcomm. Other new players, e.g., Nvidia, Horizon Robotics, and Black Sesame, have a low but rapidly growing market share, thanks to partnerships with Chinese OEMs.”

All year long, Yole Group is highlighting innovation in the automotive industry through insightful analyses on electrification, sensing technologies, computing advancements. and much more. In this regard, Yole Group remains committed to shaping the future of this dynamic sector.